24+ mortgage transfer taxes

Web The District of Columbia imposes a deed transfer tax of 11 on residential property worth less than 400000 and 145 on property worth more than 400000. In parts of Pennsylvania it can amount to more than 45 of a homes sale price.

Real Estate Transfer Taxes Deeds Com

New York State Transfer Tax 14.

. The transfer tax is ad valorum Latin for to the value and comprises a percentage of the deeds total worth. Some states charge a flat tax while others charge a percentage based on the sales price. Web Transfer tax can be a fixed amount or percentage of the assets original cost depending upon the terms and conditions set at the time of the original purchase or as per legal.

Web Watch out for California transfer taxes in transactions involving real estate holdings. Like many things there is one exception to this rule. Web No transfer taxes are not tax deductible since they are a charge to legally transfer a real estate title.

There is a doc stamp of 350 per thousand and an intangible tax of 250 per thousand required on every. PdfFiller allows users to Edit Sign Fill Share all type of documents online. Web This means that if you purchase a 4 million home in New York City with a 3 million mortgage your transfer taxes would be.

One should be from the lender who owned the loan on. Ad Download fax print or fill online. The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

Web February 27 2020 652 PM. Depending on where you live you may have. In addition most statutes list a number of cases where the transfer is exempt from taxation.

Web Deed transfer tax rates vary by state. Web In Virginia transfer taxes are 350 per 1000 of home sale price. Web A Documentary Transfer Tax is imposed on all documents that convey real property within the cities of Los Angeles County Per Revenue Taxation Code Sections 11911-11933.

Californias Revenue and Taxation Code charges. Web Refinance Property taxes are due in November. This is usually split as 1 per 1000 for the seller and 250 per 1000 for the buyer.

The National Association of REALTORS has taken an official policy position in. Web The amount youll pay in real estate transfer taxes will depend on where you live. Web The exact amount of real estate transfer taxes varies by where you live.

For some time now we have reported on the growing trend in California of. Web Most fees range from under a dollar per 100 or 500 to roughly 1 to 3 per 1000 of the transferred net value. Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

Web A transfer tax is a real estate tax usually paid at closing to facilitate the transfer of the property deed from the seller to the buyer. When your loan is sold during the year you should receive two Forms 1098. Web Compare Rates Todays Mortgage Rates 30-Year Mortgage Rates 15-Year Mortgage Rates 51 Arm Mortgage Rates 71 Arm Mortgage Rates Lender Reviews.

What Are Real Estate Transfer Taxes Bankrate

24 Sqm Studio Type Condominium Unit At Shore 1 Residences Seaside Boulevard Corner Sunrise Drive Pasay City Near Sm Mall Of Asia Ikea Smx Convention Center Macapagal Boulevard

Financial Access Under The Microscope1 In Imf Working Papers Volume 2018 Issue 208 2018

Currency Partners Import Export Experts

Calculating The State Transfer Taxes Oneblue Real Estate School Florida Real Estate Classes

Property Transfer Taxes On Real Estate Selected Countries Download Table

Tm226390d3 425img010 Jpg

Financial Access Under The Microscope1 In Imf Working Papers Volume 2018 Issue 208 2018

Real Estate Transfer Tax What Are They Where Does The Money Go

10438 W Hendee Rd Beach Park Il 60087 Mls 11675666 Trulia

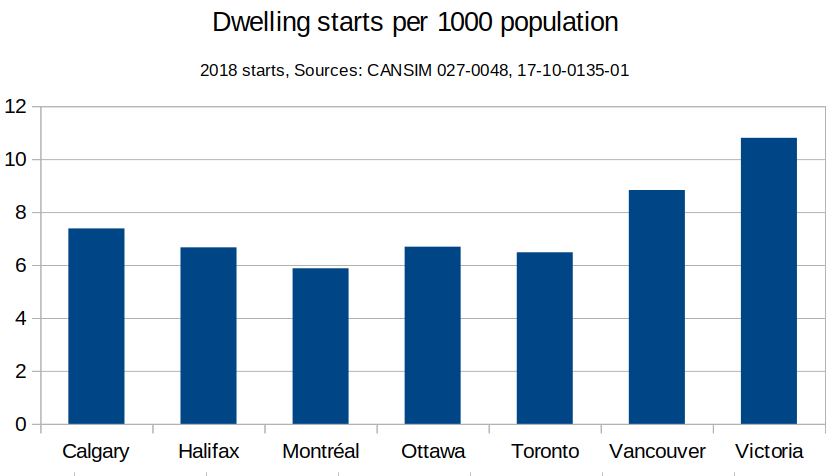

Construction Per Capita House Hunt Victoria

Transfer Taxes Are Now A Costly Consideration In Real Estate Transactions Wealth Management

Transfer Tax Changes In The Netherlands Mister Mortgage

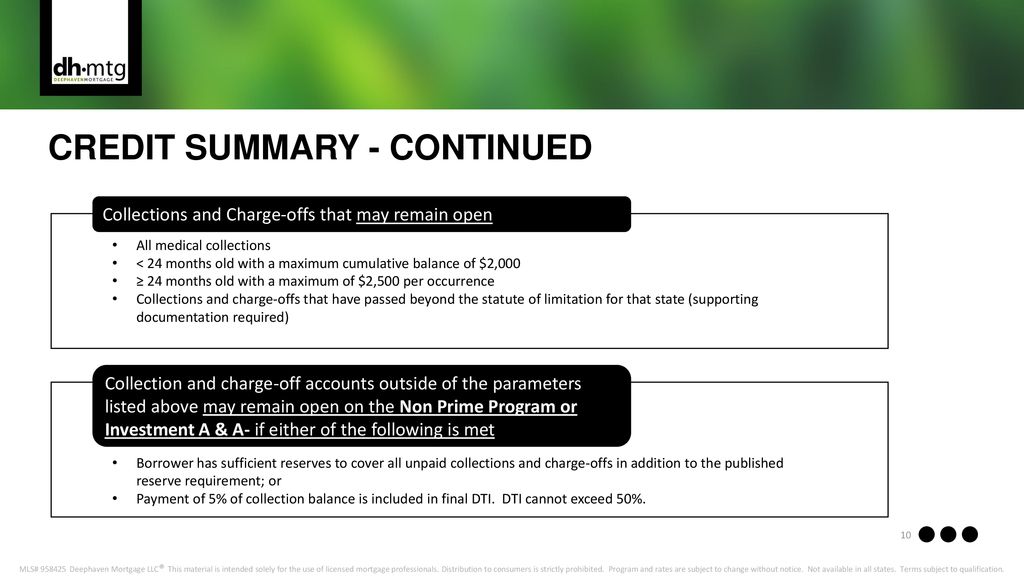

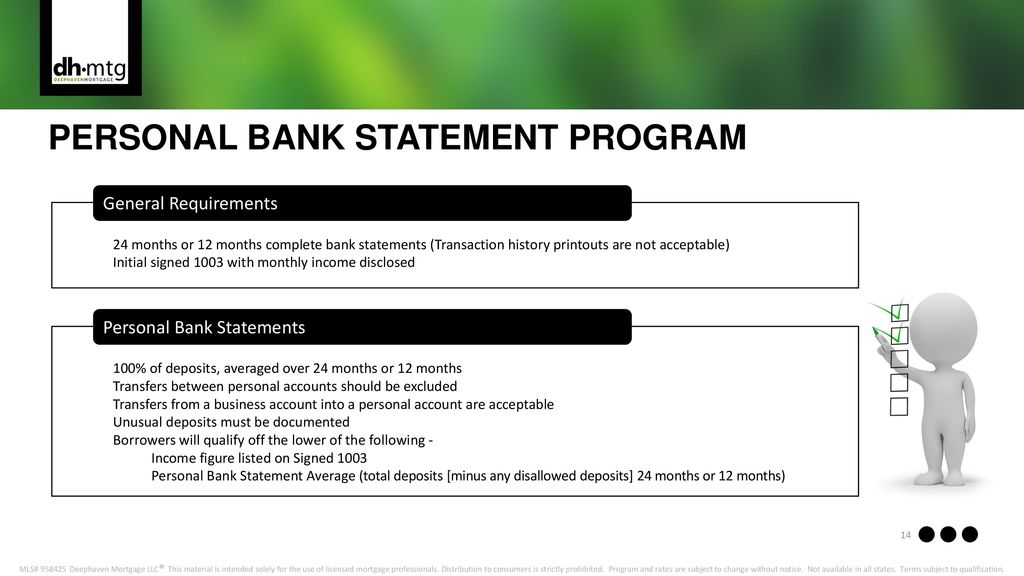

Delegated Underwriting Training Ppt Download

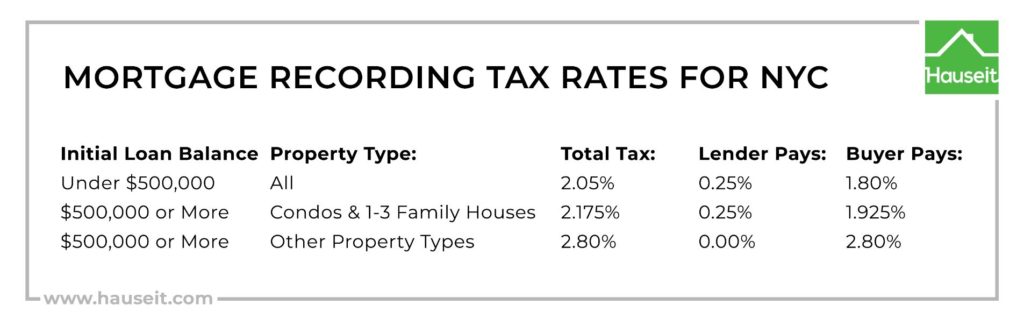

How Much Is The Nyc Mortgage Recording Tax In 2023

Document

Delegated Underwriting Training Ppt Download